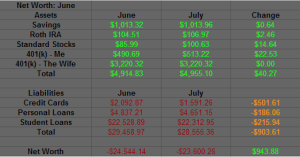

New month means a new update! I already spoke about how I knew this month was going to be rough, but we did better than I thought. We had some unplanned and planned expenses that made us go over budget by a bit…

But we still managed to pay $500 toward credit card debt! Not too shabby. August we are budgeted to pay off $700, we shall see how that pans out ;)

Savings: Untouched, just gaining interest.

Roth IRA: Untouched also but the stock market increased it.

Standard Stocks: I’m ok with get $14 for just having stocks sit there

401(k): Found the log in to my 401(k) and my wife’s! We both stopped adding to this until we can get the debt paid down. I think we might start up again once all the credit cards are paid off.

Credit Cards: We paid off one credit card leaving us with one left! But then I called them (Chase) up to get my interest rate lowered. I had a late payment over a year ago and have been paying on time since then. However they said “We reviewed your account recently and you have the lowest interest rate we can offer you.” BS. So I transferred (for free because CapitalOne is awesome) a chunk of it over to a different card. So instead of paying 29.99% on $1600, I’m paying 29.99% on $1000 and 13.96% on $600. Not the best, but still much better. If we pay $700 next month, that $1000 will become $300.

Personal and Student Loans: Just the minimum payments here.

Overall an increase of $943, sweet! Slowly but surely moving up.